Top 10 best Web 3.0 cryptos to buy in 2023

While 2022 was a chaotic year for the crypto market, 2023 could totally reshuffle the deck. This new year could also be the year of the advent of web 3.0. If you’re unfamiliar with this concept, we’ll detail it in this article.

We will also revisit several cryptos to invest in this rapidly growing sector. A sector that could weigh tens of billions of dollars in a few years. It is in any case the party taken by many analysts and some companies like Meta (former Facebook) who bet a lot on the development of the sector.

The best platforms on which to buy the best Web 3.0 cryptos

🌐 Platform | ✅ Advantage #1 | ⭐ Note |

🥇 eToro | An online broker perfectly suited for beginner traders | 4,8/5 |

🥈 Bitget | A competitive crypto platform on fees charged to traders | 4,7/5 |

🥉 OKX | A complete platform for all audiences | 4,7/5 |

Binance | The most used centralized exchange in the world | 4,9/5 |

Crypto.com | A platform that offers interesting cashback rewards | 4,6/5 |

Top 10 best Web 3.0 cryptos

We will now introduce you to the best Web 3.0 crypto projects. For a more structured portfolio, we’ve selected assets with a proven track record as well as young projects in full development.

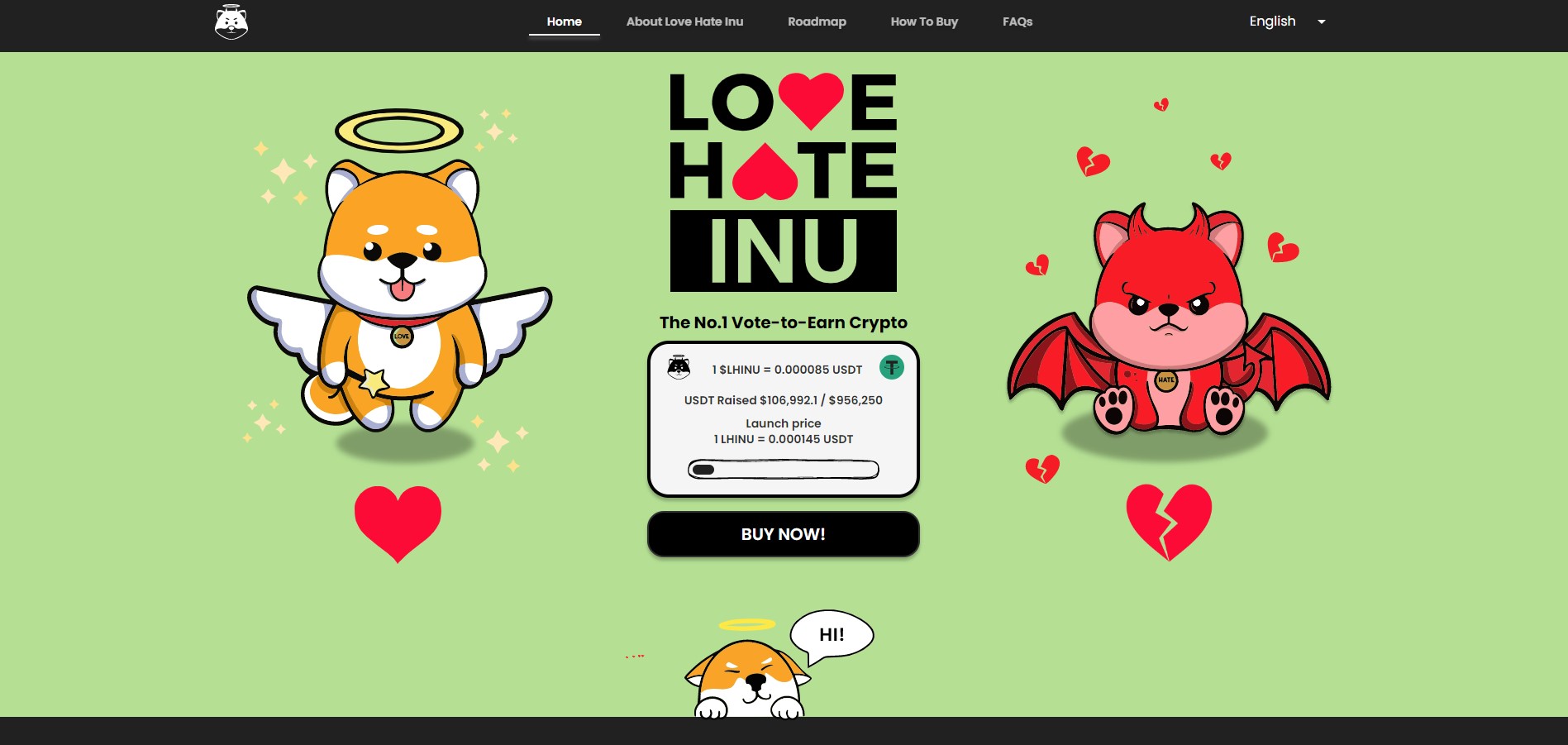

Love Hate Inu: the reference memecoin for V2E

When it comes to the world of Web3 cryptocurrencies, memecoins have undoubtedly experienced a remarkable rise in recent years. Iconic representatives of this genre, such as Tamadoge and Shiba Inu, have recorded impressive performances.

Love Hate Inu embodies the fusion between vote-to-earn and memecoins. It is a project that allows holders of its token, the LHINU, to participate in various polls. In order to vote, token holders have to stake their tokens and keep them locked for a certain amount of time. The weight of each vote depends on the number of tokens held. The project is deflationary, an important feature for the future of the token.

For those interested in investing in the early stages of the project, the Love Hate Inu team is currently raising funds through a pre-sale. This offer represents an opportunity to acquire the first $LHINU tokens in exchange for ETH or USDT. Note that the token can also be purchased by credit card.

Currently, 1 LHINU is priced at 0.000085 USDT, but the price will increase over the 8 phases of the pre-sale. At the end of the last phase, the price of the token will increase from 0.000085 to 0.000145 USDT. If you are interested in participating in the pre-sale, we advise you not to delay.

Fight Out, the new M2E reference

The FightOut project was created in response to the significant evolution of the fitness world in recent years and the difficulty of traditional gyms in creating a strong community. The innovative concept of Move to Earn (M2E) combines fitness and the web3, offering users monetary rewards for working out. The concept builds on the trend of the quest for a healthy lifestyle and the gamification of movement to encourage positive behaviors.

FightOut is both an M2E fitness app and a high-end gym chain. Users are rewarded when they complete a workout and reach goals. Their avatar evolves according to their sports performance. Users can also compete against each other, putting their real physical ability to the test.

Athletes are rewarded using a virtual currency called REPS, which is awarded according to the level of difficulty, the duration of the activity, etc. This currency is only used on the application because it is off-chain. This currency is only used on the app as it is off-chain. REPS can also be purchased using the ecosystem’s utility token, the FGHT.

Currently in pre-sale, the FGHT token offers bonuses of up to 50% extra tokens depending on the amount and acquisition period for investors.

PancakeSwap, the token of the famous DEX

PancakeSwap (CAKE) is the leading decentralized exchange (DEX) in the Binance Smart Chain (BSC). It is a highly popular platform that operates liquidity pools in a decentralized and automated manner using algorithms.

PancakeSwap’s native token is CAKE, which is considered one of the emerging cryptocurrencies. The purpose of this token is to facilitate cryptocurrency transactions on the exchange. Automated Market Makers (AMMs), like PancakeSwap, simplify transactions by using liquidity pools. Users who participate in these pools receive a reward in CAKE as a percentage of the amount of transactions made on the network.

PancakeSwap continues to continuously improve in line with its roadmap, competing with other DEX. The platform offers one of the best user experiences and has demonstrated unprecedented Web3 expansion in recent months. PancakeSwap will soon receive a major update that will bring new tools and a major overhaul of the NFT platform.

RobotEra, the game Play to Earn metaverse

RobotEra is a blockchain game that allows users to build their own world within a metaverse. Within this game, the user can embody a robot, presented as an NFT.

RobotEra uses some of the codes that made the success of metavers like The Sandbox or Decentraland. With the possibility to manage your own Land, also represented as NFT.

Like The Sandbox or Decentraland, the user will be able to express his creativity almost infinitely with the tools made available in RobotEra. Within the ecosystem, you can also find themed worlds with the possibility of accessing concerts, museums or amusement parks.

A place of creation par excellence, the RobotEra metaverse allows you to navigate easily between different universes to discover or re-discover the creations of other users.

Decentraland, project token number 1 of the metaverse

If you’re looking to invest in a crypto-currency, the MANA token is a must-have in the metaverse. A native token of the Decentraland project, it is based on the Ethereum blockchain and is therefore an ERC-20 token. On the Decentraland platform, the MANA token is used as the main payment method for many services, including the purchase and development of virtual properties. In addition, it is essential for acquiring LANDs, i.e. NFTs that certify the ownership of land parcels in this virtual world.

These plots can be used to build various real estate projects and monetize them later. Apart from the Decentraland platform, MANA tokens are widely used in the market and are therefore highly liquid, which means that they can be traded easily on various crypto-currency platforms. If you are looking to invest in the metaverse, the MANA token is a great option to consider.

UniSwap, the native token of the famous DEX

If you are interested in the Web3 world, you are probably familiar with decentralization. This concept is at the heart of discussions and projects aimed at developing products and services accessible to all, without the need for a trusted third party or intermediary to facilitate transactions, as is the case with centralized platforms.

UniSwap is one of the most important projects in DEX. This platform is based on the Ethereum blockchain and offers its users a solution to buy and sell cryptocurrencies in a decentralized way. As an AMM (Automated Market Maker) protocol, UniSwap bypasses traditional order books by using various indicators, such as capitalization and trading volume, to determine the price of tokens in real time.

Uniswap has improved the efficiency of decentralized exchanges by solving liquidity problems with automated solutions.

Then, in 2020, Uniswap created its own native token, the UNI. The token offers some profit potential to users, and gives them the opportunity to participate in building the future of this decentralized entity.

Ethereum, the leader of the web3

The Ethereum project, the world’s first DeFi project and second blockchain after the king Bitcoin, needs no introduction. On every new trend in the crypto market, the Ethereum blockchain is often a forerunner.

Leader on the NFT segment, Ethereum is also the most used blockchain in the world when it comes to decentralized finance. If we have often heard about Ethereum Killer, we have to admit that the main altcoins are still far from the strength of the Ethereum network.

By switching last fall from a Proof of Work protocol to the Proof of Stake, the blockchain is now much less energy intensive. This transition should, in the long run, reduce transaction costs and solve network congestion problems.

Binance Coin, combining web3 and centralized exchange

The Binance Coin (BNB) is the governance token of the Binance platform, the number 1 exchange in the world. Like other blockchains, the Binance Chain has understood the interest and potential of the web3.

In fact, it is the scene of many project launches that put the web3 in the spotlight. Like most other crypto projects, Binance Coin has undergone the market during this year 2022.

But despite heavy losses, the project is outperforming Bitcoin, Ethereum and the vast majority of large altcoins. Proof that users now believe in this project a lot.

Cosmos, the internet of blockchains

The Cosmos project is perhaps one of the most maximalist in terms of decentralization. It is indeed an ecosystem of independent and interoperable blockchains.

Because if Ethereum, Solana or Algorand blockchains are layer 1 blockchains, Cosmos is a layer 0 blockchain, as we can also find with Polkadot and Avalanche.

Very active on the thorny issue of blockchain interoperability, Cosmos could be one of the big winners in the advent of web3. The ATOM token is the native token of the Cosmos Hub blockchain. Like other protocols, Cosmos allows the staking of its token.

Chainlink, the oracle of the web 3

The Chainlink blockchain offers an ecosystem of decentralized oracles. Thanks to these oracles, users can easily verify information that is essential to the realization of a smart contract.

Chainlink’s fields of application can be extremely varied: from validating a bet on a soccer match to obtaining information on the price of a stock market index or a cryptocurrency.

Note that the blockchain Chainlink is in the process of deploying a Proof of Reserve offer that should allow to audit the crypto assets of an entity. An offer that is totally in line with the times, especially with the collapse of the FTX exchange.

What is a Web 3.0 crypto?

A web3 crypto is based on a fundamental principle: decentralization. A web3 crypto is a token that supports a project that is part of the theme of a decentralized web, in opposition to what we know today: the web 2.0.

Indeed, the current version of the Internet remains very centralized with dominant players: the famous GAFAM (Google, Apple, Facebook, Amazon, Microsoft).

The web3 projects are therefore built in opposition to these multinationals with colossal financial power. And to structure themselves, they use blockchains in particular. Besides its decentralized aspect, web 3.0 also allows users to regain control of their personal data.

Personal data so often scorned in the world of web 2.0. Note that some cryptos of web3 also put forward the NFT. Other themes, related to web3 as the metaverse are also sometimes put forward.

How does a Web 3.0 crypto work?

Each web3 crypto project has its own way of working. If it is necessary to respect a certain number of elements like decentralization, one could be tempted to say that there are as many different ways of functioning as there are web 3.0 cryptos.

Also, depending on the size of the projects, the possibilities will be more or less important. Indeed, it’s hard to compare the web 3.0 crypto Ethereum and its $150 billion capitalization to small projects that launch into web3.

Note that some projects stamped web 3.0 use metavers or NFT, two “tools” very popular in this new wave of Internet.

Why buy a Web3 crypto?

In this section, we will see why it could be interesting to invest in web3 projects. In addition to the opportunities that this sector offers, the financial promises are often there. Let’s look at several arguments to consider.

The beginning of Web 3

Investing in a fast-growing sector is always exciting. While the web3 sector is still in its infancy, it could find unsuspected opportunities in the months or years to come.

According to a study by Emergent Research published in May, the web3 market could be worth over $80 billion by 2030. As a reminder, the market was worth just over $3 billion in 2021.

Decentralization

For those who believe in decentralization, investing in web3 projects is almost a given. Decentralization offers many advantages. And the first one is obviously the absence of control from a central entity.

Investing in a web3 crypto allows you to fight against the censorship of an entity that would be the only decision maker. From a security point of view, decentralization also allows you to limit the risks of hacking and piracy.

Relatively low prices

While the market could be worth more than $80 billion by 2030, the web3 is still in its infancy. This means that the price of the sector’s assets is still largely undervalued compared to the performance they could produce in the future.

But be careful, because a booming sector also means a lot of risks and turnover. It is likely that some players will disappear as quickly as they arrived on the web 3.0 market. Caution must therefore be exercised.

Portfolio diversification

Investing in web3 projects also allows you to diversify your portfolio. If you already invest in stocks and web2 projects like Amazon or Google, it may be appropriate to diversify your portfolio by focusing on web3 projects.

Similarly, if you’re investing in Bitcoin, it may be worth investing in projects that have the web3 in mind. From Ethereum to new projects coming to market to boost your portfolio.

Projects that provide solutions

Technically, web3 projects can be expressed in a multitude of universes. A lot of existing projects are taken up in the web3 style, by incorporating decentralization.

If we take the example of the sports betting industry, some applications or blockchains already allow users to validate or invalidate their predictions.

All this, using a fully decentralized and incorruptible system. Technically, web3 is applicable to every part of web2, offering a decentralized counterpart.

P2E Cryptos

P2E projects are also a branch of the web3. Concretely, these projects have reversed the relationship of users to video games. Because before the emergence of this type of games, the user paid to play by buying his video game on a marketplace or in a physical store.

P2E games have turned the industry upside down by offering rewards to players who are active on their platforms. This new form of business model has been illustrated by the game Axie Infinity. Today, there are many Play to Earn projects such as Tamadoge or Calvaria.

Where and how to buy a Web 3.0 crypto?

In this last part, we will see several methods to buy web 3.0 cryptos. Often, the way to buy will depend on the maturity of the project.

On the official website of the crypto

When a crypto project launches, it is often through an ICO. Before the asset is available on centralized and decentralized exchanges, you will often be able to buy the asset on the platform’s website. At the moment, this is the case with the D2T token of the Dash 2 Trade platform.

By going directly to the platform’s website, you will be able to buy the D2T token, currently available for pre-sale.

Here are the steps to follow to buy the token:

- Step 1: Connect your MetaMask Wallet or Trust Wallet to the platform

- Step 2 : buy the D2T token with ETH, USDT or with your credit card

- Step 3: Wait until the end of the presale to claim your tokens

On a specialized platform

Once a project is launched, it becomes available on other platforms. It is then the law of supply and demand that forms the price on exchanges like Pancakeswap, Uniswap, Binance or Crypto.com. Other players such as brokers also make it possible to invest in web3 projects.

- Step 1: Create an account

- Step 2: Validate your account

- Step 3: Make your first deposit (minimum $50)

- Step 4: Buy web3.0 cryptos

Conclusion

The web3 is growing rapidly and could be one of the most important opportunities for blockchains. Despite a year 2022 marked by the bear market, the arguments in favor of the decentralized web are not lacking. Starting with the growth rate of this sector which could be worth more than 80 billion dollars by 2030.

If you want to invest in web3 projects, there are several possibilities. Whether through specialized brokers, exchanges or through the platform’s website during a presale.

If the sector has great potential, keep in mind that it remains extremely competitive and that the volatility of an investment is to be considered before launching.

FAQ about web 3.0 cryptos

What are the best Web 3.0 cryptos?

This is a difficult question to answer. If some projects that focus on the web3 are already present and installed for a while, like Ethereum, others are trying to make a place for themselves in a sector that will explode in the coming years.

Where to buy the best Web 3.0 cryptos?

As we have seen, you can buy web 3.0 cryptos on the platforms’ website at the time of the launch of the projects or from specialized brokers’ platforms like eToro. It is also possible to go through centralized exchanges like Binance or decentralized ones like Pancakeswap.

Why buy a Web 3.0 crypto?

The web3 is a fast growing sector. And its annual growth rate is breathtaking. Estimated at 3 billion dollars in 2021, the sector could represent more than 80 billion dollars by 2030. If the projects stamped web3 are likely to multiply, we still advise you to invest by choosing mature projects but also by opting for a few projects that are starting up.